Tim Mektrakarn

March 11, 2025

6 GRC Tools for SMBs and Startups in 2025

In the fast-paced world of small and medium-sized businesses and startups, navigating governance, risk management, and compliance (GRC) can seem daunting. GRC tools are not just reserved for large enterprises with massive budgets and teams of engineers. They are critical for the growth and sustainability of smaller ventures, too.

In this article, we’ll explore the role of GRC tools in leveling the compliance playing field for SMBs and startups. If you are interested in a deeper discussion around compliance for SMBs and startups, contact Bright Defense.

What is a GRC Tool?

A GRC Tool is a software solution designed to help organizations manage Governance, Risk, and Compliance effectively. It streamlines the complex processes involved in ensuring that a business operates within regulatory requirements, manages risks efficiently, and follows internal policies and procedures. Here’s a breakdown of each component:

Key Features of a GRC Tool

- Risk Assessment and Monitoring: Identifies and evaluates risks, allowing organizations to prioritize and manage them effectively.

- Compliance Tracking: Ensures that all business activities comply with relevant regulations and standards.

- Audit Management: Streamlines the audit process by linking evidence to controls, making audits more efficient.

- Policy Management: Centralizes policy creation, distribution, and updates, ensuring everyone is on the same page.

- Incident Management: Provides tools for identifying, reporting, and resolving incidents that could disrupt operations.

Best GRC Tools and Services for Startups and Small Businesses

Let’s check out the quality GRC tools and services that you can rely on:

1. Drata Review

Drata is a powerful GRC tool known for its seamless automation, intuitive interface, and extensive integration options. It simplifies compliance by automating evidence collection, monitoring controls, and managing risks across frameworks like SOC 2, HIPAA, GDPR, and now HITRUST.

Key Features of Drata

- Comprehensive Compliance Monitoring: Tracks compliance across multiple frameworks, including SOC 2, HIPAA, GDPR, and HITRUST.

- Customizable Policy Templates: Allows organizations to tailor policies to their specific needs.

- Real-Time Monitoring: Provides continuous oversight of controls for ongoing compliance.

- Integration with 120+ Tools: Seamlessly connects with popular SaaS applications for operational efficiency.

- Centralized Document Management: Streamlines compliance tracking and document storage.

- 24/7 Customer Support: Offers structured onboarding and reliable customer assistance.

Pros

- Fast Implementation and Configuration: Quick and easy setup for rapid deployment.

- Cost-Effective, Audit-Ready Templates: Simplifies audit preparation and saves time.

- Seamless Integrations: Connects smoothly with over 120 tools.

- Real-Time Monitoring: Ensures continuous compliance across various controls.

Cons

- Limited Third-Party Integrations: Has fewer integration options compared to some competitors.

- Complex for New Users: Steep learning curve for beginners, especially in the free version.

Drata Pricing

Drata offers different pricing editions, ranging from $7,500 to $15,000 per year. These plans are designed to meet different organizational needs, depending on the size and complexity of compliance requirements. For more detailed pricing information and to find the best fit, it’s recommended to contact Drata directly.

Final Verdict

Drata is undoubtedly a top-tier GRC solution, offering powerful automation, user-friendly features, and extensive integrations that simplify compliance management. With its newly added HITRUST framework support, it’s an even more comprehensive tool for businesses looking to stay audit-ready with minimal hassle. Drata remains a leading choice for efficient and reliable compliance management.

2. Bright Defense Review

Bright Defense delivers fully managed GRC services that keep businesses compliant with essential security standards, including SOC 2, ISO 27001, PCI DSS, HIPAA, and GDPR. Backed by CISSP and CISA-certified experts, our approach goes beyond checklists—we design and implement tailored cybersecurity strategies that ensure continuous protection and audit readiness.

Key Features of Bright Defense

- Ongoing Cybersecurity Compliance: Regular risk assessments, policy implementation, and business continuity planning to maintain consistent security and compliance.

- Unified Compliance Platform: Centralized monitoring across all regulatory frameworks, simplifying the complexity of compliance management.

- Virtual CISO (vCISO): Access to seasoned security professionals who provide strategic oversight and guide cybersecurity initiatives.

- Customized Security Solutions: Tailored compliance strategies designed by experts who understand the specific needs and challenges of managed service providers.

Pros

- All-Inclusive Compliance: Supports compliance with major standards like SOC 2, ISO 27001, PCI DSS, HIPAA, and GDPR.

- Budget-Friendly: Offers enterprise-level security without the high cost of in-house security teams or consultants.

- Expert-Led Strategy: Guided by certified security specialists, ensuring reliable and effective cybersecurity strategies.

- Scalable and Flexible: Perfectly suited for small businesses and MSPs with up to 10 employees and a single audit framework.

Cons

- Tiered Feature Access: Not all features are available in the base plan; advanced features require higher-tier subscriptions.

Bright Defense Pricing

Bright Defense offers three cost-effective plans tailored to different business needs:

- Sentry ($1,000/month): Essential compliance tools, including the Compliance Automation Platform and 24 hours of vCISO services per year. Ideal for startups and small businesses looking for affordable security solutions.

- Guardian ($2,000/month): Adds advanced features such as Gap Analysis, Risk Assessment, and Policy Development, delivering a more comprehensive compliance strategy.

- Defender ($3,000/month): The most extensive package, offering complete security with Business Continuity Planning, Annual Audits, and Penetration Testing. This plan ensures enterprise-level protection at a fraction of traditional consulting costs.

Final Verdict

Bright Defense offers a practical and cost-effective approach to cybersecurity compliance, catering to the needs of small businesses and managed service providers.

The flexible pricing plans make it easy to find the right fit, whether you need basic compliance tools or full-scale protection.

Bright Defense helps businesses stay secure and audit-ready without the high expenses of hiring in-house security teams. If you’re looking for a scalable solution to meet regulatory requirements, Bright Defense is worth considering.

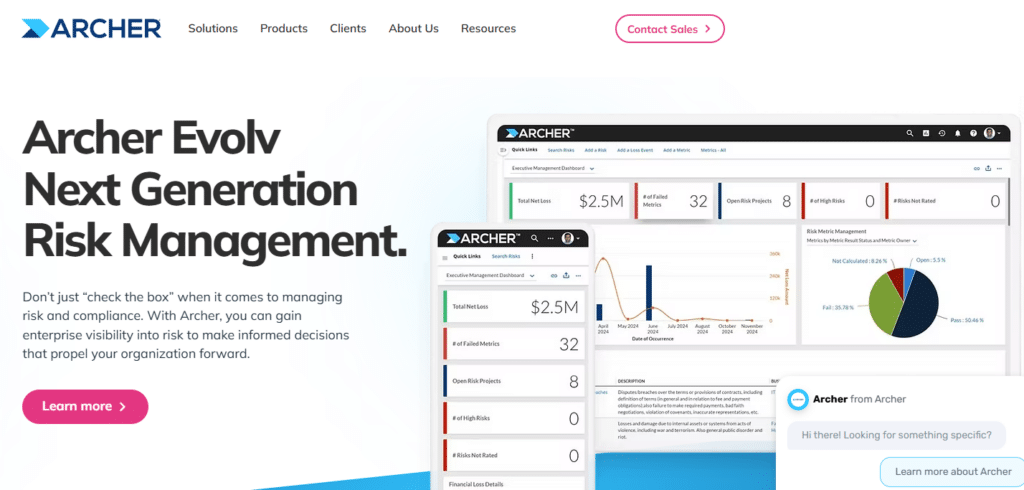

3. Archer Review

Archer stands out as a leading governance, risk, and compliance (GRC) platform, helping organizations effectively manage risk, meet regulatory requirements, and protect their valuable assets. Its modular design makes it adaptable for various industries, seamlessly integrating risk management into daily business processes.

Key Features of RSS Archer

RSA Archer offers an extensive suite of features that cover all aspects of GRC, including:

- IT and Security Risk Management: Identifies and mitigates cybersecurity threats and vulnerabilities.

- Enterprise and Operational Risk Management: Facilitates strategic risk assessments to ensure business continuity.

- Regulatory and Corporate Compliance: Assists in adhering to industry standards and regulatory requirements.

- Audit Management: Streamlines internal audits for efficient reporting and issue tracking.

- Business Continuity Planning: Ensures operational resilience during disruptions.

- Public Sector Solutions: Tailored solutions for governmental compliance and risk management.

- Third-Party Risk Management: Evaluates risks associated with vendors and third parties.

- ESG and Operational Resilience Management: Monitors environmental, social, and governance (ESG) risks.

Pros

- Extensive GRC Features: Comprehensive tools for managing every aspect of governance, risk, and compliance.

- Flexible Workflow Customization: Highly adaptable workflows to match unique organizational needs.

- Detailed Dashboard View: Real-time insights and analytics provide clear visibility into the risk landscape.

- Customizable Reports: Tailored reporting capabilities for in-depth analysis and informed decision-making.

- Access Control Flexibility: Administrators can set granular access controls, ensuring users only see relevant information.

Cons

- User Interface Needs Improvement: The interface feels outdated and could benefit from a more intuitive design.

- Search Function Limitations: The search tool is not as powerful as expected, impacting navigation and usability.

Archer Pricing

RSA Archer does not list pricing on its website, but typical costs per risk area range between $30,000 and $50,000. Organizations should contact RSA for a tailored quote based on their specific needs.

Final Verdict

RSA Archer is a powerful GRC platform offering a comprehensive set of features that cater to a wide range of industries. Its flexibility and customization options are ideal for organizations looking to integrate risk management seamlessly into their daily operations. However, the outdated user interface and subpar search functionality could be a drawback for some users.

4. IBM OpenPages Review

IBM OpenPages is a comprehensive Governance, Risk, and Compliance (GRC) platform designed to help organizations manage risk and regulatory requirements effectively. Here’s an overview based on user reviews and product features:

Key Features of IBM OpenPages

- Integrated Risk Management: Centralizes various risk management functions into a unified platform, allowing for consistent monitoring and management across the organization.

- AI-Powered Assistance: Incorporates IBM’s Watson to provide AI-driven insights, enhancing decision-making and automating routine compliance tasks.

- Customizable Workflows: Offers configurable workflows, enabling organizations to tailor processes to their specific compliance and risk management needs.

- Comprehensive Reporting: Features robust reporting tools, including integration with IBM Cognos, to generate detailed analytics and reports for informed decision-making.

Pros

- User-Friendly Interface: Users appreciate the intuitive design, which simplifies navigation and reduces the learning curve.

- Scalability: The platform is noted for its scalability, making it suitable for organizations of varying sizes.

- Strong Customer Support: IBM provides responsive and helpful support, assisting users in maximizing the platform’s potential.

Cons

- Customization Costs: While the platform allows for customization, implementing advanced workflows and triggers may require additional investment in IBM’s services.

- Complex Reporting Tools: Some users find the reporting features, particularly those involving IBM Cognos, to be less user-friendly and challenging to configure.

IBM OpenPages Pricing

IBM OpenPages pricing starts at approximately $3,300 per user per year for the Essentials edition, making it an accessible entry point for smaller organizations or those just beginning to implement GRC solutions.

For businesses needing more advanced features and broader functionalities, the Standard, Single Solution, and Enterprise editions are available, with prices ranging from $6,050 to $9,000 per user per year.

These higher-tier packages cater to larger organizations with complex compliance needs, offering enhanced customization, integration, and reporting capabilities.

Pricing scales based on the number of users and specific configurations required, allowing organizations to choose a package that best fits their operational requirements and budget.

Final Verdict

IBM OpenPages stands out as a robust GRC solution, integrating AI capabilities to enhance risk management and compliance processes. Its scalability and comprehensive feature set make it a strong contender for organizations seeking an all-encompassing platform. However, potential users should consider the additional costs associated with advanced customizations and be prepared for a learning curve with certain reporting tools.

5. Vanta Review

Vanta is a compliance automation platform that helps organizations manage security audits, risks, and compliance with standards such as SOC 2, ISO 27001, HIPAA, and GDPR. Its user-friendly dashboard and automation features simplify evidence collection and real-time monitoring.

Key Features of Vanta

- Automated Compliance Monitoring: Continuously tracks security controls to maintain compliance across multiple frameworks.

- Customizable Templates: Offers pre-built policy templates that can be adjusted to meet specific organizational needs.

- Integration with 300+ Tools: Connects with popular cloud services and SaaS applications for efficient operations.

- Real-Time Alerts and Notifications: Keeps users informed of compliance status and security incidents.

- User-Friendly Dashboard: Provides a centralized view of compliance metrics and audit readiness.

- Dedicated Customer Support: Offers onboarding assistance and ongoing support.

Pros

- Easy Setup and Configuration: Fast deployment with minimal manual intervention.

- Time-Saving Automation: Reduces manual workload by automating evidence collection and monitoring.

- Extensive Integrations: Connects easily with a wide range of cloud services and SaaS tools.

- Scalable Solution: Works well for startups and growing businesses.

Cons

- Limited Customization: Less flexibility in customizing reports compared to competitors.

- Higher Pricing for Small Teams: Can be expensive for smaller organizations with limited budgets.

Vanta Pricing

Vanta’s pricing is based on company size and selected features. For organizations with 1–20 employees, the Core Package starts at approximately $11,500 per year.

The Growth Package, suitable for the same employee range, is priced at about $22,675 annually, while the Scale Package starts around $48,970 per year. Additional features like the Trust Center and Vendor Risk Management are available at extra costs.

Final Verdict

Vanta is a solid compliance automation tool, offering useful integrations, automated monitoring, and an intuitive interface. It’s a good choice for organizations looking to simplify compliance and maintain security standards.

Although it comes with a higher price tag, the time and effort saved make it a valuable option for businesses focused on security.

6. Secureframe Review

Secureframe is a compliance automation platform designed to simplify the process of obtaining and maintaining certifications like SOC 2, ISO 27001, HIPAA, and GDPR. It automates evidence collection, monitors compliance in real time, and integrates with a wide range of tools, making compliance management more efficient and less burdensome.

Key Features of Secureframe

- Automated Evidence Collection: Secureframe streamlines audit preparation by automating the collection of compliance evidence, significantly reducing manual effort.

- Real-Time Compliance Monitoring: The platform continuously tracks security controls to ensure ongoing compliance with industry standards.

- Customizable Policy Templates:

It provides ready-made policy templates that can be tailored to fit an organization’s unique requirements. - Integration with Over 300 Tools:

Secureframe connects seamlessly with numerous cloud services and third-party applications, offering flexibility and ease of use. - Audit Management:

The platform simplifies audit management by generating detailed reports and actionable insights, helping organizations stay prepared for audits. - Comprehensive Customer Support:

Secureframe offers dedicated support, guiding users through onboarding and providing expert advice throughout the compliance journey.

Pros

- Intuitive User Interface: Secureframe features a clean and easy-to-navigate design, enhancing the overall user experience.

- Efficient Automation: By automating evidence collection and compliance tracking, the platform significantly reduces manual work.

- Extensive Integration Options: With compatibility across a wide range of cloud services and tools, Secureframe seamlessly fits into existing tech ecosystems.

Cons

- Expensive for Smaller Teams: Secureframe’s pricing might be prohibitive for smaller businesses due to its premium cost structure.

- Steep Learning Curve: New users may find the initial setup process challenging, especially without prior compliance experience.

Secureframe Pricing

Secureframe’s pricing starts at around $7,500 per compliance framework activated. For companies with up to 100 employees, an additional annual fee of about $7,500 is charged. Larger organizations can expect to pay between $15,200 and $29,800 annually, depending on the size and complexity of their compliance needs.

These pricing estimates are based on user feedback and third-party sources, as Secureframe does not publicly list detailed pricing information. For accurate and customized pricing, it’s recommended to contact Secureframe directly.

Final Verdict

Secureframe is an effective compliance management solution that combines automation, real-time monitoring, and extensive integrations to simplify compliance processes. It’s particularly valuable for organizations looking to maintain high security standards while reducing the manual workload associated with audits.

While the pricing might be on the higher side for smaller businesses, its powerful features, ease of use, and exceptional customer support make it a worthwhile investment for growing companies. Overall, Secureframe delivers a reliable and efficient compliance management experience, making it a smart choice for businesses of all sizes.

Note: The price estimates of most of the tools are collected from user feedback and third-party sources. Most of them do not explicitly mention prices on their website. For precise pricing tailored to your organization’s needs, it’s recommended to contact each provider directly.

How to Choose the Best GRC Tool for Your Business Needs

Choosing the right Governance, Risk, and Compliance (GRC) tool is essential for effectively managing risks, staying compliant with regulations, and streamlining internal policies. But with so many options out there, how do you pick the one that fits your business needs?

Here’s a straightforward guide to help you make an informed decision:

1. Understand Your Business Requirements

Before diving into the sea of GRC tools, take a moment to understand your organization’s specific needs. What are the regulatory requirements you must comply with? Are you dealing with industry-specific standards like GDPR, HIPAA, or SOX? Knowing your compliance landscape is the first step in narrowing down your options. Also, identify the types of risks you need to manage—whether they’re operational, financial, or cybersecurity-related.

2. Look for Essential Features

Not all GRC tools are created equal. Make sure the one you choose offers:

- Risk Assessment and Management: Effective tools should provide risk identification, evaluation, and mitigation options.

- Compliance and Policy Management: Automation in compliance tracking and streamlined policy management saves time and reduces human error.

- Audit and Incident Management: An ideal GRC tool should support seamless auditing and quick incident response to minimize disruptions.

- Third-Party Risk Management: If you work with vendors, look for a tool that can manage third-party risks and ensure compliance.

3. Check Integration and Scalability

Your GRC tool should integrate smoothly with your existing systems like ERP, CRM, or other management software. This not only ensures a streamlined workflow but also enhances data accuracy. Additionally, as your business grows, your GRC tool should be able to scale up without requiring a complete overhaul.

4. Prioritize User Experience

A GRC tool is only effective if your team actually uses it. Choose a tool with an intuitive interface that’s easy to navigate. Customizable dashboards and reports are also a plus, allowing you to tailor the tool to your organization’s needs.

5. Evaluate Vendor Reputation and Support

Don’t just focus on the tool itself; consider the vendor’s track record. Look for a provider known for delivering reliable GRC solutions and having experience in your industry. Good customer support is crucial, so ensure they offer responsive and knowledgeable assistance.

6. Assess Total Cost of Ownership

While upfront costs are important, don’t forget about ongoing expenses like maintenance, support, and potential upgrades. Compare the cost with the value it brings in terms of risk mitigation and operational efficiency to understand its return on investment.

7. Ensure Strong Security and Data Protection

Your GRC tool will handle sensitive data, so robust security features are non-negotiable. Look for:

- Data Encryption: Protects sensitive information from unauthorized access.

- Access Controls: Ensures only authorized personnel have access to critical data.

Choosing the right GRC tool involves more than just ticking boxes. It’s about finding a solution that fits your unique business needs, integrates smoothly with your existing systems, and grows with your organization.

Understanding the Role of GRC in SMEs and Startups

Governance, Risk Management, and Compliance (GRC) is an integrated framework that ensures an organization’s activities align with its business goals while managing risks effectively and staying compliant with relevant laws and regulations. It encompasses practices and processes that help companies oversee and control their operations, make informed decisions, and anticipate and mitigate potential risks. GRC is a strategic approach to managing a company’s overall governance, internal and external risk management, and regulatory compliance, ensuring long-term sustainability and success.

While larger corporations may have dedicated teams for these functions, SMEs and startups often need to handle these critical areas with more limited resources. This makes understanding and implementing efficient GRC strategies and tools even more vital.

Challenges Faced by SMEs and Startups

SMEs and startups typically operate in a dynamic environment where they must adapt quickly to market changes and regulatory demands. Unlike larger organizations, they often lack the luxury of large budgets or specialized personnel dedicated solely to GRC activities. This scenario presents unique challenges. These include:

- Resource Constraints: Limited budget and manpower to address complex GRC requirements.

- Evolving Regulatory Landscape: Keeping up-to-date with changing laws and regulations across different jurisdictions.

- Risk Management: Identifying, assessing, and mitigating risks in an agile business environment.

- Technology Integration: Integrating GRC processes with existing systems and workflows.

These challenges, however, also present opportunities for SMEs and startups to adopt innovative GRC tools designed for their specific needs. Such tools can streamline processes, reduce manual errors, and help make informed, strategic decisions.

The Path Ahead

This post aims to demystify GRC for SMEs and startups, guiding them through the available tools and helping them understand how to leverage these for better governance, comprehensive risk management, and seamless compliance. The subsequent sections will delve into the intricacies of GRC in the context of smaller businesses, explore the features and benefits of various GRC tools, and provide practical advice for their selection.

GRC Fundamentals for SMBs and Startups

For SMBs and startups, the governance structure must be adaptable. These organizations need to establish clear decision-making processes without the bureaucracy that can slow down larger entities. Risk management must be proactive, enabling these agile businesses to pivot swiftly in response to market changes. When it comes to compliance, they face a dynamic regulatory environment that requires a nimble approach.

Implementing a compliance framework such as SOC 2 or NIST Cybersecurity Framework at a company’s early stage helps engrain the practices and enables a better risk-based culture. When compliance is implemented in larger organizations, it’s much harder to establish buy-in quickly. The leads to a “check the box” mentality.

Key Features of GRC Tools for SMEs and Startups

Tailoring GRC Tools for Smaller Enterprises

For small and medium enterprises (SMEs) and startups, the right GRC tools can be a game-changer, offering streamlined processes and strategic insights. When evaluating GRC tools, certain features stand out as particularly beneficial for smaller businesses:

User-Friendliness and Ease of Integration

- Simplicity is Key: Tools should have an intuitive interface that doesn’t require extensive training. This is crucial for SMEs and startups, where employees often wear multiple hats.

- Seamless Integration: The ability to integrate with existing systems ensures that GRC processes blend smoothly into the company’s workflow, minimizing disruption and learning curves. Achieving a level of automation makes the compliance journey more streamlined. Many GRC tools, like Drata and Vanta, have a myriad of integration partners with cloud-based services. These include Identity Providers, Cloud Service Providers, HRIS platforms, Device Management, Endpoint Protection and Response, Security Awareness Training, Ticketing, Version Control Systems, and more.

Automation Capabilities

- Integrations and automation allow employee information to be ingested into the platform, automated processes such as performing background checks, assigning security awareness training, monitoring MFA enrollment, ensuring device management policies have been applied, assigning policies and tracking acknowledgment.

- You can also track developer access and changes to code repositories to ensure compliance with the security policies in place. When it’s time to off board an employee, the platform helps track employee access.

- When it comes to infrastructure, platforms like Drata have integration points to the major public Cloud providers like AWS, Azure and GCP. Here they can pull in assets, and check policies through the API. Drata’s automated monitors check configurations multiple times daily. Failed tests can be easily tracked for remediation.

Scalability to Grow with the Business

- Adaptable Solutions: As businesses grow, their GRC needs evolve. Tools that are scalable allow for expansion and additional features without the need for a complete system overhaul.

- Flexible Pricing Models: Cost structures that scale with the size and needs of the business are essential. This ensures that SMEs and startups aren’t paying for more than what they use.

Cost-Effectiveness and ROI

- Affordable Solutions: Budget constraints are a reality for smaller businesses. GRC tools offering competitive pricing without compromising on essential features are highly desirable.

- ROI Consideration: Tools should provide a clear value proposition, whether through time savings, reduced risk, or compliance cost reduction.

Customizability to Meet Specific Industry Needs

- Industry-Specific Features: Different industries have varying compliance and risk management needs. Customizable tools that cater to these specific requirements are more effective.

- Modular Approach: The ability to choose and implement features based on current needs helps in managing costs and complexity.

A Strategic Asset for SMEs and Startups

Incorporating these features, GRC tools can become a strategic asset. They enable SMEs and startups to proactively manage risks, ensure compliance, and align their operational activities with their business objectives. The next section will delve into the tangible benefits these tools bring to the table, further highlighting their significance in the growth and sustainability of smaller enterprises.

Benefits of GRC Tools for SMBs and Startups

Implementing robust GRC tools can streamline governance, allowing SMBs and startups to focus on their core business activities. These tools can help businesses manage risks effectively, building resilience against unexpected market shifts. Let’s delve further into the benefits of GRC solutions.

Enhanced Risk Management and Mitigation

- Proactive Risk Identification: GRC tools enable businesses to identify potential risks before they become issues, allowing for proactive management.

- Strategic Risk Assessment: These tools provide frameworks for assessing and prioritizing risks, ensuring that resources are allocated effectively to mitigate them.

Improved Regulatory Compliance and Reporting

- Stay Up-to-Date with Regulations: Automated updates in GRC tools help businesses keep up with changing compliance requirements. This reduces the risk of non-compliance.

- Streamlined Reporting Processes: Simplified and automated reporting capabilities ensure that regulatory filings are accurate, timely, and less resource-intensive.

Strengthened Governance and Organizational Structure

- Clear Governance Frameworks: GRC tools help in establishing clear governance structures and processes, ensuring all levels of the organization understand their roles and responsibilities.

- Enhanced Decision-Making: By providing comprehensive visibility into governance processes and risk profiles, these tools aid in making more informed, strategic decisions.

A Path to Sustainable Growth

Implementing GRC tools effectively positions SMEs and startups for sustainable growth. By ensuring that they are managing risks adequately, complying with regulatory requirements, and making informed strategic decisions, these tools lay a foundation for long-term success. In the next section, we will explore some of the top GRC tools suitable for SMEs and startups, providing a guide to selecting the right tool for your business needs.

Selecting the Right GRC Tools for Your Business

When evaluating GRC tools, SMBs and startups should consider their business size and stage. For early-stage startups, tools that offer basic compliance and risk assessment features might be enough. As they grow, more sophisticated features such as cross-walking between multiple compliance frameworks becomes necessary. Tools like Vanta, Carbide, and Drata offer a range of functionalities that cater to different stages of business growth, and user testimonials often shed light on how these tools perform in real-world scenarios.

Here are some additional tips to choosing the right solution for your needs:

Assess Your Specific GRC Requirements

- Understand Your Needs: Identify the specific governance, risk, and compliance challenges your business faces. This could range from industry-specific regulatory requirements to internal risk management needs.

- Prioritize Features: Based on your needs, prioritize the features you require in a GRC tool, such as compliance tracking, risk assessment capabilities, or reporting functionalities.

Research and Compare Available Tools

- Create a Shortlist: Compile a list of GRC tools that seem to fit your requirements. Look for tools specifically designed for SMEs and startups, as they will likely offer the scalability and cost-effectiveness needed.

- Compare Features and Pricing: Evaluate each tool on your shortlist based on the features they offer and their pricing structures. Consider both current needs and potential future requirements as your business grows.

Consider User Experience and Support

- Ease of Use: A tool that is user-friendly and easy to navigate can significantly reduce the learning curve and increase adoption rates among your team.

- Customer Support: Especially important for SMEs and startups is the level of customer support provided. Ensure that the tool comes with adequate support and training resources.

Look for Integration Capabilities

- Compatibility with Existing Systems: The chosen GRC tool should integrate seamlessly with your existing software systems (like ERP, CRM, etc.) to ensure a smooth workflow and data consistency.

- Data Import/Export Capabilities: The ability to easily import existing data into the GRC tool and export reports and analytics is crucial for efficient operation.

Making an Informed Choice

By carefully evaluating and choosing the right GRC tool, SMEs and startups can ensure they are well-equipped to handle the complexities of governance, risk management, and compliance. The right tool not only aids in meeting regulatory requirements but also plays a pivotal role in strategic decision-making and long-term business sustainability.

Future Trends in GRC for SMEs and Startups

Anticipating Changes and Innovations in Governance, Risk, and Compliance

As the landscape of business, technology, and regulations continues to evolve, SMEs and startups must stay informed about the future trends in GRC. This section delves into the anticipated changes and innovations that are likely to shape GRC strategies in the coming years.

Increased Emphasis on Integrated Risk Management

- Holistic Approach: There will be a shift towards a more integrated approach to risk management, blending traditional risk management with strategic planning and decision-making processes.

- Predictive Analytics: The use of predictive analytics in risk management will become more prevalent, enabling businesses to foresee potential risks and mitigate them proactively.

Advancements in Artificial Intelligence and Machine Learning

- AI-Driven Compliance: AI technologies will increasingly be used to automate compliance processes, making them more efficient and less prone to human error.

- Enhanced Risk Detection: Machine learning algorithms will evolve to detect and assess risks more accurately, offering deeper insights into potential vulnerabilities.

Greater Focus on Cybersecurity and Data Privacy

- Cybersecurity Governance: As cyber threats become more sophisticated, GRC tools will integrate more advanced cybersecurity governance features.

- Data Privacy Regulations: With increasing emphasis on data privacy (e.g., GDPR, CCPA), GRC tools will need to continually adapt to help businesses comply with these evolving regulations.

Expansion of Environmental, Social, and Governance (ESG) Criteria

- ESG Integration: There will be a growing trend of integrating ESG factors into GRC frameworks, aligning risk management with sustainability and social responsibility goals.

- Reporting Standards: Expect standardization in ESG reporting, with GRC tools incorporating features to facilitate this.

Cloud-Based GRC Solutions

- Accessibility and Scalability: Cloud-based GRC solutions will become more popular, offering greater scalability and accessibility for SMEs and startups.

- Enhanced Collaboration: These cloud platforms will facilitate better collaboration and data sharing across different departments and external stakeholders.

Regulatory Technology (RegTech) Innovation

- Automated Compliance: The rise of RegTech will see more automated solutions for staying compliant with regulatory changes.

- Real-Time Compliance Monitoring: Continuous, real-time monitoring of compliance status will become a key feature of advanced GRC tools.

Staying Ahead of the Curve

For SMEs and startups, staying informed about these trends is crucial for future-proofing their GRC strategies. By anticipating these changes, they can adapt their approaches, invest in the right technologies, and maintain a competitive edge in an increasingly complex business environment. The key is to remain agile, open to innovation, and proactive in integrating these emerging trends into their GRC practices.

Conclusion

Emphasizing the Critical Role of GRC Tools in Modern Business Operations

As we conclude this discussion on GRC tools for SMEs and startups, it’s essential to recap the significant role these tools play in the contemporary business landscape. This guide has explored the various facets of Governance, Risk, and Compliance (GRC), underlining how crucial they are for the efficient and secure operation of smaller and emerging businesses.

Central to Business Strategy and Sustainability

- GRC tools are not just about compliance and risk management; they are integral to forming a robust business strategy. They enable SMEs and startups to navigate the complex web of regulations and risks, ensuring long-term sustainability and growth.

Empowering Informed Decision Making

- With comprehensive GRC tools, businesses gain insights into potential risks and compliance requirements, leading to more informed and strategic decision-making. This is vital in a business environment where agility and foresight are key competitive advantages.

Fostering a Culture of Compliance and Risk Awareness

- Implementing GRC tools helps in building a culture where compliance and risk management are embedded in everyday operations. This cultural shift is crucial for the proactive identification and mitigation of risks.

Encouragement for Proactive GRC Management

For SMEs and startups, proactively managing governance, risk, and compliance is not just a regulatory requirement; it’s a strategic imperative. In a world where business risks and regulatory landscapes are constantly evolving, staying ahead requires tools that offer agility, foresight, and adaptability.

- Invest in the Right Tools: Choosing the right GRC tool is a foundational step in this journey. It’s about finding a solution that aligns with your specific business needs, scales with your growth, and integrates smoothly into your operations.

- Engage and Educate Your Team: Implementing a GRC tool is as much about technology as it is about people. Engage your team in understanding its importance, and invest in training to maximize its utility.

- Stay Informed and Adaptable: The future trends in GRC indicate a landscape that will continue to change. Stay informed about these changes and be ready to adapt your tools and strategies accordingly.

A Call to Action for Future-Ready Governance

As we look ahead, the message is clear: SMEs and startups must view GRC not as a compliance obligation, but as a strategic asset. It’s an investment in the stability and future of your business. With the right GRC tools in place, you are not just complying with the present but preparing for the future. Embrace these tools as part of your journey towards a more secure, compliant, and successful business.

About Bright Defense

Bright Defense protects our clients from cybersecurity threats through continuous compliance. We are a Drata Service Partner. We offer continuous compliance services, including risk assessments, risk mitigation, and information security program development. Our unique monthly engagement model delivers a fully managed cybersecurity program that meets compliance frameworks, including SOC 2, HIPAA, CMMC, NIST 800-53, NIST 800-171, ISO 27001, and more.

Additionally, we specialize in small to medium businesses and startups. Our risk and compliance programs are tailored to meet your needs and budget.

Get started on your compliance journey today with Bright Defense!

FAQ: Understanding GRC in SMEs and Startups

What is the role of risk management in GRC?

Risk management is a core component of GRC, focusing on identifying, analyzing, and mitigating risks that could impact the organization’s operations and objectives. Effective risk management within a GRC framework helps businesses foresee potential issues, make informed decisions, and maintain operational resilience.

How do compliance processes integrate with GRC software?

Compliance processes are seamlessly integrated into GRC software, allowing organizations to automate and streamline their compliance activities. This integration ensures that compliance requirements are consistently met, and any changes in regulations are promptly addressed, helping maintain compliance effectively.

Why are internal audits important in a GRC strategy?

Internal audits play a crucial role in a GRC strategy as they provide an objective assessment of the effectiveness of internal controls, risk management practices, and compliance processes. They help identify areas of improvement and ensure that the organization adheres to its GRC program.

How do external audits differ from internal audits in GRC?

External audits are conducted by independent third parties and focus on evaluating the accuracy of an organization’s financial records and ensuring compliance with external regulations. In contrast, internal audits are conducted by the organization itself to assess internal controls and the effectiveness of its GRC programs.

What is the significance of digital transformation in GRC?

Digital transformation in GRC involves leveraging technology to enhance the efficiency and effectiveness of governance, risk, and compliance activities. This includes automating routine tasks, improving data analysis, and facilitating better communication and reporting, enabling organizations to assess risk and manage compliance more effectively.

How can organizations assess risk in their GRC programs?

Organizations can assess risk in their GRC programs by conducting regular risk assessments, which involve identifying potential risks, evaluating their impact and likelihood, and developing strategies to mitigate them. This is crucial for improving risk management and ensuring the robustness of the GRC program.

What is third-party risk, and how is it managed in GRC?

Third-party risk refers to the potential risks that arise from outsourcing processes or partnering with external entities. Managing this risk within GRC involves conducting due diligence on third parties, monitoring their compliance, and ensuring they align with the organization’s risk management strategies.

How can GRC software improve risk management for SMEs and startups?

GRC software can significantly improve risk management by providing tools for real-time risk monitoring, automated risk assessments, and streamlined reporting. This enables SMEs and startups to quickly identify and respond to risks, enhancing their overall risk management capabilities.

What are internal controls, and how do they relate to GRC programs?

Internal controls are processes and procedures put in place to ensure the integrity of financial and operational activities. In the context of GRC programs, they are crucial for ensuring compliance, preventing fraud, and maintaining efficient operations within an organization.

Get In Touch