Tim Mektrakarn

February 17, 2025

PCI DSS Scoping and Segmentation for Modern Network Architectures

Welcome to the world of PCI DSS scoping and segmentation! If you’re managing payment card data, you’ve probably heard about the need to secure your systems and keep everything in line with the Payment Card Industry Data Security Standard (PCI DSS). But as our networks evolve, so do the challenges of keeping everything secure. Let’s dive into how scoping and segmentation play a crucial role in modern network architectures—and why they matter to you.

Understanding PCI DSS Scoping and Segmentation

Before we dive into the details, let’s get on the same page with some key terms. When we talk about “scoping” in the context of PCI DSS, we’re defining which parts of your network are involved in storing, processing, or transmitting cardholder data. Segmentation, on the other hand, is all about isolating those parts to limit the PCI DSS scope and reduce security risks.

Think of segmentation as building walls between your sensitive data and everything else. It’s not just about keeping things secure—it’s also about making compliance easier by reducing the number of systems that fall under the PCI DSS umbrella.

Modern Network Architectures and Their Impact on PCI DSS

With tech evolving faster than ever, traditional network security methods like perimeter firewalls just don’t cut it anymore. Let’s break down some modern network architectures and what they mean for PCI DSS Scoping and Segmentation.

Multi-Cloud Environments

Multi-cloud setups are like having a foot in multiple boats—Amazon Web Services (AWS), Microsoft Azure, Google Cloud, you name it. It’s great for redundancy, flexibility, and avoiding vendor lock-in, but it can also make managing PCI DSS scope a nightmare. Each cloud provider has its own rules, tools, and quirks, which complicates segmentation. The key here is to establish clear boundaries and keep a close eye on your configurations.

Zero-Trust Architectures

Zero-trust is exactly what it sounds like: trust no one. It flips the traditional “inside the perimeter is safe” mentality on its head. Instead, zero-trust requires every user and system to verify their identity continuously, regardless of their location in the network. This approach pairs well with segmentation since it restricts access based on strict criteria. It’s a match made in security heaven—but implementing it can be complex and time-consuming.

Hybrid Cardholder Data Environments

A hybrid environment mixes on-premises infrastructure with cloud-based services. It’s the best of both worlds—keeping sensitive data close while leveraging the scalability of the cloud. But with great power comes great responsibility, and segmentation in hybrid environments can be tricky. You need to ensure consistent security controls across both on-prem and cloud components to keep your PCI DSS scope in check.

Network Virtualization Technologies

Technologies like Software-Defined Networking (SDN) and service meshes are changing the game by abstracting the physical network into a virtual one. They make segmentation more dynamic, allowing you to create isolated environments at the drop of a hat. But they also introduce new challenges, such as maintaining consistent policies across complex, constantly shifting networks.

Key Segmentation Strategies for Modern Architectures

So, how do you segment effectively in these modern environments? Here are a few strategies to keep in mind:

- Micro-Segmentation: Instead of just segmenting your network broadly, micro-segmentation drills down to individual workloads, services, or even containers. It’s like locking every door inside your house, not just the front one.

- Namespaces and Isolated Environments: In container orchestration systems like Kubernetes, namespaces allow you to create distinct environments within the same infrastructure, keeping different apps and data isolated.

- Consistent Policies and Access Controls: Make sure your access rules are applied consistently, no matter where your data resides. This is crucial for maintaining segmentation and preventing unauthorized access.

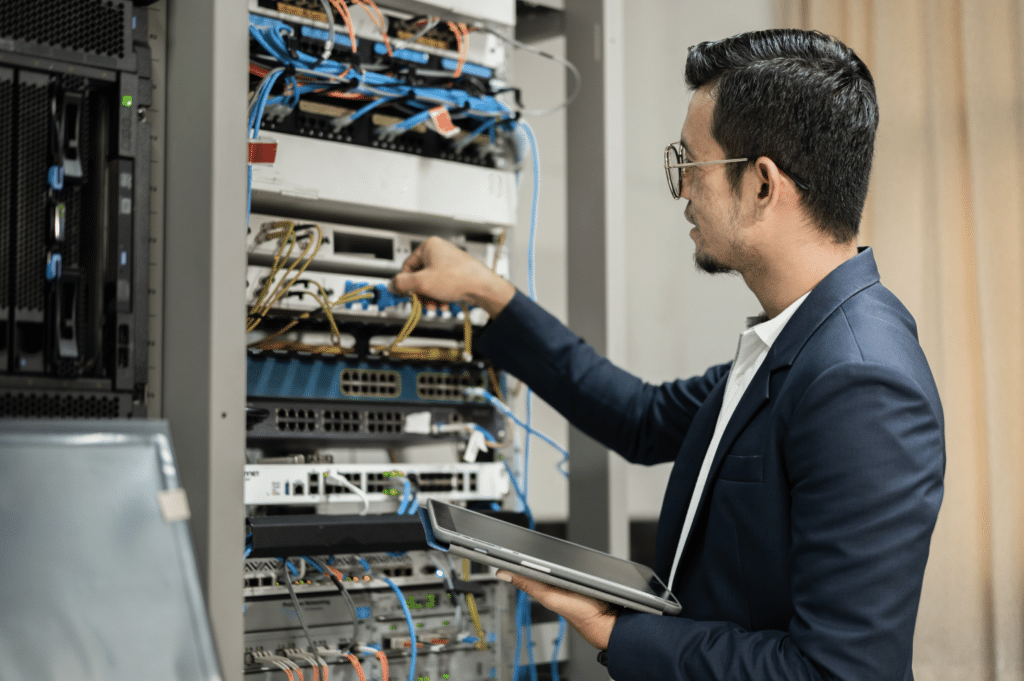

Penetration Testing of Segmentation Controls

No matter how airtight you think your segmentation is, you need to test it regularly. Penetration testing is all about finding the cracks before the bad guys do. In multi-cloud, zero-trust, and hybrid environments, pen testing should focus on validating that your segmentation controls are working as intended. Think of it as a stress test for your security boundaries.

Continuous validation and monitoring are essential in maintaining effective segmentation. You’re not just setting it and forgetting it; you’re always verifying and adapting to changes in your network.

Best Practices for Managing PCI DSS Scoping and Segmentation in Modern Environments

- Keep Your Diagrams Up-to-Date: Accurate network diagrams and data flow mappings are your best friends when managing PCI DSS scope. Use automated tools to keep track of changes and maintain an accurate view of your network landscape.

- Automate Where You Can: Modern environments are dynamic, and manual processes just won’t cut it. Use automation to monitor changes in segmentation and detect any potential security gaps.

- Document Everything: Good documentation isn’t just a checkbox; it’s essential. Keeping detailed records of your scoping and segmentation decisions helps you stay compliant and provides a clear trail if something goes awry.

Challenges and Risks with Modern Segmentation Approaches

Modern approaches to segmentation bring their own set of risks. Multi-cloud environments can lead to misconfigurations, zero-trust can be complex to implement, and virtualized networks can introduce new attack vectors. Staying on top of these risks means constantly reviewing your controls, validating your configurations, and adapting to new threats.

Conclusion

As networks become more complex, effective segmentation becomes more critical—and more challenging. But with the right strategies, tools, and a commitment to continuous improvement, you can keep your PCI DSS scope manageable and your data secure. So, take a proactive approach, stay informed, and keep evolving with your network.

About Bright Defense

Ready to upgrade to PCI DSS 4.0? Bright Defense is here to ensure a seamless transition from 3.2.1 with expert guidance and tailored PCI services. Our seasoned consultants use advanced tools like Drata to automate evidence collection, monitor controls, and manage your PCI scope efficiently. We combine technical expertise with a deep understanding of compliance, working closely with your team to implement robust security measures that meet the latest standards. Whether you’re enhancing cloud security, implementing network segmentation, or tackling new MFA requirements, we’re with you every step of the way. Let Bright Defense simplify your path to PCI DSS 4.0 compliance—contact us today to get started!

Additional Resources

For more in-depth guidance, check out the PCI DSS documentation on the PCI Security Standards Council’s website, and stay tuned for updates as technologies and standards evolve.

PCI DSS 4.0 FAQ: Everything You Need to Know

PCI DSS 4.0, the latest version of the Payment Card Industry Data Security Standard, brings new requirements, enhanced security measures, and changes to the compliance landscape. Below are some frequently asked questions to help you navigate PCI DSS 4.0 and understand what it means for your organization.

1. What is PCI DSS 4.0?

PCI DSS 4.0 is the latest version of the Payment Card Industry Data Security Standard, which sets the security requirements for organizations that handle payment card data. Released in 2022, this version introduces new and updated requirements to address evolving threats, enhance security measures, and provide more flexibility for compliance.

2. Why was PCI DSS updated to version 4.0?

PCI DSS 4.0 was updated to address the changing landscape of payment security. Key reasons include evolving threats, to keep pace with emerging threats and technologies, the update enhances security controls and introduces more stringent requirements. It provides flexibility and customization, offering organizations more flexibility in implementing security controls through customized approaches. The update includes clarifications and guidance, with clearer instructions and additional guidance to help organizations meet compliance requirements. It also emphasizes continuous security by encouraging continuous monitoring and real-time threat detection instead of periodic assessments.

3. What are the major changes in PCI DSS 4.0?

Here are some of the significant changes introduced in PCI DSS 4.0: enhanced authentication requirements that strengthen requirements for multifactor authentication (MFA) and password security; a customized approach option that allows organizations to meet requirements using customized methods, provided they demonstrate equivalent or better security outcomes; a focus on continuous monitoring with new requirements for real-time monitoring, alerting, and responding to threats; expanded scope on e-commerce and cloud security, providing more guidance and requirements for securing cloud environments and web applications; and updated encryption standards with enhanced requirements for data encryption to keep up with advancing cryptographic standards.

4. What is the Customized Approach in PCI DSS 4.0?

The Customized Approach in PCI DSS 4.0 allows organizations to meet security objectives in a way that best fits their unique environment, rather than strictly following traditional prescriptive controls. This approach requires a documented risk analysis and proof that the customized security controls achieve equivalent or better protection than the standard requirement.

5. What are the timelines for implementing PCI DSS 4.0?

The transition timeline for PCI DSS 4.0 is as follows: PCI DSS 4.0 was published in March 2022. Organizations can continue to validate compliance with PCI DSS 3.2.1 until March 2024. By March 2025, all organizations must fully comply with PCI DSS 4.0, including new and enhanced requirements. Organizations are encouraged to start planning and implementing the new requirements as soon as possible to ensure a smooth transition.

6. What are the key requirements for multifactor authentication (MFA) in PCI DSS 4.0?

PCI DSS 4.0 strengthens MFA requirements to ensure that all access to the cardholder data environment (CDE) is protected by robust authentication mechanisms. Key points include that MFA is required for all non-console administrative access and all remote access to the CDE. Authentication factors must be independent, such as not using the same device for multiple factors, and additional logging and monitoring requirements are in place to detect failed authentication attempts.

7. How does PCI DSS 4.0 address cloud environments?

PCI DSS 4.0 provides more guidance on cloud security and emphasizes the shared responsibility model between cloud service providers (CSPs) and their customers. Key aspects include clearer definitions of what constitutes “in-scope” for PCI DSS in cloud environments, guidance on securing cloud configurations, monitoring, and managing cloud service access, and requirements for segmentation and isolation within multi-tenant cloud environments to protect cardholder data.

8. How does PCI DSS 4.0 impact encryption requirements?

PCI DSS 4.0 enhances encryption requirements to ensure that data is protected during transmission and at rest. This includes stronger requirements for cryptographic key management, updated algorithms and key lengths to align with current cryptographic standards, and mandatory use of TLS 1.2 or higher for encrypting data in transit, with guidance to implement TLS 1.3 where possible.

9. How should organizations approach the transition to PCI DSS 4.0?

Here are some steps organizations can take to transition smoothly to PCI DSS 4.0: Conduct a Gap Analysis to identify what’s required to move from PCI DSS 3.2.1 to 4.0, highlighting any new or modified requirements that impact your environment. Update policies and procedures to revise your security policies, processes, and controls to align with PCI DSS 4.0 requirements. Enhance security controls by implementing the necessary technical changes, such as strengthening MFA, updating encryption protocols, and improving monitoring capabilities. Train staff to ensure that all employees, especially those handling sensitive data, are aware of new security practices and compliance requirements. Engage with assessors early by working with Qualified Security Assessors (QSAs) to get feedback on your readiness and address any potential compliance issues.

10. What happens if an organization fails to comply with PCI DSS 4.0?

Non-compliance with PCI DSS 4.0 can lead to severe consequences, including fines and penalties imposed by payment brands or acquirers for non-compliance, loss of payment privileges where merchants could lose their ability to process credit card transactions, and reputation damage as breaches due to non-compliance can result in loss of customer trust and potential legal action. Organizations should work proactively to meet PCI DSS 4.0 requirements to avoid these risks.

11. How does PCI DSS 4.0 promote continuous security?

PCI DSS 4.0 emphasizes continuous security by encouraging organizations to adopt practices that go beyond periodic assessments. This includes continuous monitoring and logging with real-time monitoring of systems, with automated alerts for suspicious activity, regular testing involving ongoing testing of security controls, including penetration testing and vulnerability scanning, to identify and address risks quickly, and incident response planning with enhanced requirements for incident detection, response, and recovery, ensuring organizations can react promptly to security incidents.

12. Where can I find more information about PCI DSS 4.0?

For more detailed information, guidance documents, and official resources, visit the PCI Security Standards Council website. It provides comprehensive resources, including the PCI DSS 4.0 standard, FAQs, and additional training materials to help you achieve compliance.

Got more questions about PCI DSS 4.0? Feel free to reach out, and we’ll help you navigate these new standards and ensure your organization stays compliant!

Get In Touch