John Minnix

February 26, 2025

SOC 1 vs. SOC 2: Key Differences Explained

System and Organization Controls (SOC) reports are pivotal for businesses aiming to build trust and ensure robust internal controls in cybersecurity and regulatory compliance. SOC reports provide a framework for organizations to demonstrate their commitment to maintaining high-security standards, availability, and confidentiality. However, navigating the different types of SOC reports, specifically SOC 1 vs. SOC 2, can be challenging.

This article focuses on comparing SOC 1 vs. SOC 2. Whether you are a service provider dealing with financial reporting, or a company managing sensitive data, knowing which SOC report aligns with your needs can enhance your compliance efforts and strengthen your market position. Let’s get started to determine which framework is right for you.

What is SOC 1?

SOC 1, or System and Organization Controls 1, is a report that focuses on a service organization’s internal controls over financial reporting (ICFR). The primary purpose of SOC 1 is to provide assurance to the organization’s clients and auditors that the service organization has adequate controls in place to handle and protect financial data. SOC 1 reports are particularly relevant for businesses involved with their client’s financial statements. Examples include payroll processing, transaction processing, and financial reporting services.

Key Aspects and Scope of SOC 1

SOC 1 reports assess the design and operational effectiveness of controls relevant to a service organization’s client’s financial reporting. These reports are tailored to the specific needs of users. They focus on controls that could impact the accuracy and integrity of financial data. SOC 1 reports do not cover operational controls related to security, confidentiality, or privacy unless they directly affect financial reporting.

Types of SOC 1 Reports: Type I and Type II

There are two types of SOC 1 reports:

- SOC 1 Type I: This report evaluates the design and implementation of controls at a specific point in time. It assures the controls are suitably designed to meet the control objectives as of the report date.

- SOC 1 Type II: This report evaluates the design and implementation of controls and examines their operating effectiveness over a specified period, typically six months to a year. It provides a more comprehensive assessment of the controls’ effectiveness over time.

Industries and Scenarios Where SOC 1 is Applicable

SOC 1 reports are particularly relevant for service organizations directly impacting their clients’ financial reporting processes. Industries where SOC 1 reports are commonly used include:

- Payroll Processing: Companies providing payroll services must ensure that their processes and controls accurately handle employee compensation, tax withholdings, and benefits.

- Transaction Processing: Businesses involved in processing financial transactions, such as credit card processing or electronic funds transfer, must demonstrate that their systems are secure and accurate.

- Financial Reporting Services: Organizations offering services that support the preparation of financial statements must show that their controls ensure the integrity and accuracy of financial data.

What is SOC 2?

SOC 2, or System and Organization Controls 2, is a report designed to evaluate an organization’s controls relevant to security, availability, processing integrity, confidentiality, and privacy. Unlike SOC 1, which focuses on financial reporting, SOC 2 intends to ensure that a service organization’s operations and compliance controls safeguard data and systems integrity.

Key Aspects and Scope of SOC 2

SOC 2 reports assess an organization’s adherence to the AICPA’s Trust Services Criteria (TSC), which encompass five key areas:

- Security: Protection of system resources against unauthorized access.

- Availability: System accessibility as stipulated by a contract or service level agreement (SLA).

- Processing Integrity: Assurance that system processing is complete, valid, accurate, timely, and authorized.

- Confidentiality: Protection of information designated as confidential.

- Privacy: Protection of personal information in accordance with the organization’s privacy notice.

These criteria ensure that a service organization’s systems are secure and reliable. They provide a comprehensive framework for managing data and protecting against threats.

Types of SOC 2 Reports: Type I and Type II

There are two types of SOC 2 reports:

- SOC 2 Type I: This report evaluates the design and implementation of controls at a specific point in time. It assures that the controls are suitably designed to meet the criteria as of the report date.

- SOC 2 Type II: This report assesses the design and operating effectiveness of controls over a specified period, typically six months to a year. It offers a more in-depth evaluation of the organization’s controls and their effectiveness over time.

Industries and Scenarios Where SOC 2 is Applicable

SOC 2 reports are relevant for any service organization that handles or processes customer data. Common scenarios and industries where SOC 2 reports are used include:

- Cloud Service and SaaS Providers: Companies offering cloud-based services must demonstrate that their systems are secure and reliable to earn client trust.

- Data Centers and IT Managed Services: Organizations managing data storage, processing, and IT infrastructure must ensure their controls protect client data.

- Healthcare Services: Companies handling sensitive health information must comply with stringent privacy and security requirements.

- Financial Services: Firms processing financial data need robust controls to protect against unauthorized access and data breaches.

Key Differences Between SOC 1 and SOC 2

While SOC 1 and SOC 2 reports play vital roles in ensuring an organization’s controls are effective, they serve distinct purposes. Understanding the differences is crucial for choosing the right report for your business.

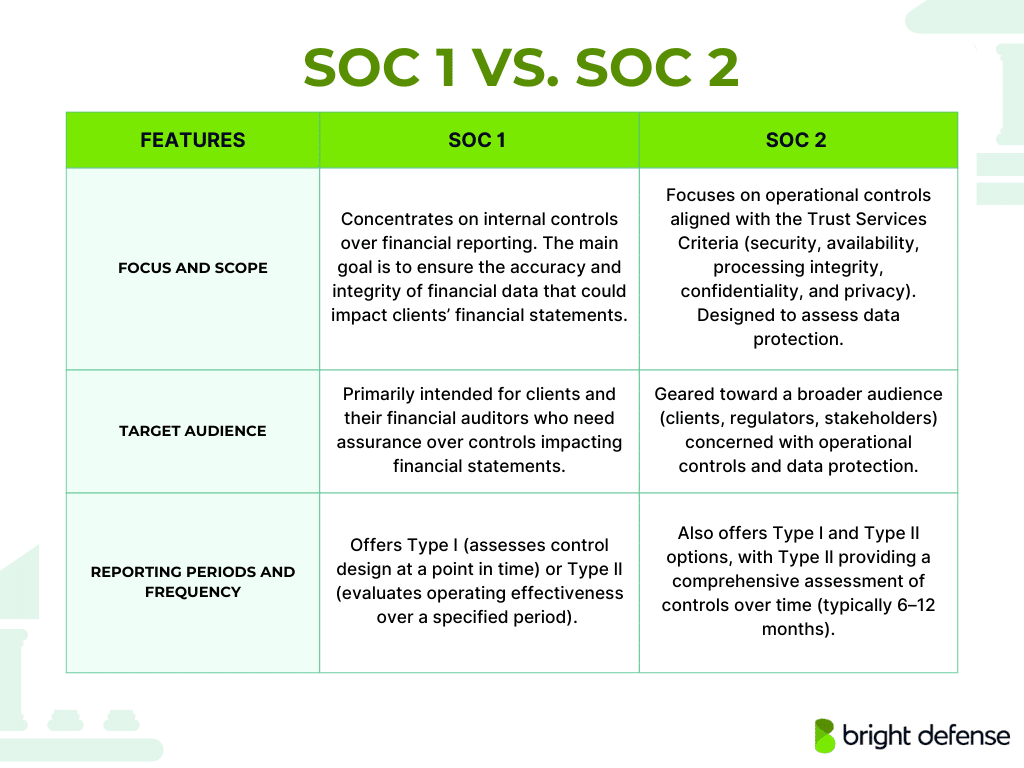

Focus and Scope

- SOC 1: Concentrates on internal controls over financial reporting. Its primary purpose is to ensure the accuracy and integrity of financial data that could impact the financial statements of the organization’s clients.

- SOC 2: Focuses on operational controls related to the Trust Services Criteria of security, availability, processing integrity, confidentiality, and privacy. It is designed to assess how well an organization protects and manages customer data.

Target Audience

- SOC 1: Primarily intended for the organization’s clients and their financial auditors, who need assurance about the controls over financial reporting.

- SOC 2: Geared towards a broader audience, including clients, regulators, and stakeholders interested in the organization’s operational controls and data protection practices.

Reporting Periods and Frequency

- SOC 1: Can be either a Type I or Type II report. A Type I report evaluates the design of controls at a specific point in time, while a Type II report assesses the operating effectiveness of controls over a specified period.

- SOC 2: Also offers Type I and Type II reports, with Type II providing a more comprehensive assessment of controls over time, typically six months to a year.

Choosing Between SOC 1 and SOC 2

Selecting the appropriate SOC report depends on various factors related to your business operations, client needs, and industry requirements. Here are some key considerations:

Business Requirements and Industry Standards

- SOC 1: If your organization’s services directly impact your client’s financial reporting, a SOC 1 report is likely the appropriate choice. This is especially true for payroll processing, transaction processing, and financial reporting services.

- SOC 2: If your organization handles sensitive data and needs to demonstrate strong operational controls, SOC 2 is the better option. This report is particularly relevant for cloud service providers, data centers, IT-managed, healthcare, and financial services.

Client and Stakeholder Expectations

- SOC 1: Your clients and their auditors may request a SOC 1 report to ensure your controls meet their financial reporting requirements.

- SOC 2: Clients concerned about data security, availability, and privacy will find SOC 2 reports more relevant. These reports assure that your organization is committed to protecting their data.

Regulatory and Compliance Needs

- SOC 1: Organizations subject to regulatory requirements related to financial reporting will benefit from SOC 1 compliance. This is often the case for publicly traded companies and those in heavily regulated industries.

- SOC 2: Compliance with data protection regulations and standards, such as GDPR, HIPAA, and CCPA, may necessitate a SOC 2 report. It demonstrates your commitment to maintaining high standards of data security and privacy.

Which One Should You Pick?

If you’re handling tasks directly tied to your clients’ financial statements (like payroll or transaction processing), SOC 1 is what you need. It proves your controls are reliable for financial reporting.

If your main focus is protecting data—ensuring security, availability, and privacy—SOC 2 is your go-to. It shows you have robust operational controls to keep information secure, which is vital for data-centric and cloud-based services.

Ultimately, choose SOC 1 for financial reporting assurance and SOC 2 for demonstrating strong data security and privacy practices.

Navigating Dual Compliance: The Need for Both SOC 1 and SOC 2

Certain organizations may need both SOC 1 and SOC 2 reports. This dual compliance is often necessary for businesses operating in complex industries where financial reporting and operational controls are critical.

Organizations Requiring Both SOC 1 and SOC 2

- Financial Service Providers: Companies that offer a range of services, including transaction processing and cloud-based financial management, may need SOC 1 to assure clients of their financial data controls and SOC 2 to demonstrate their commitment to data security and privacy.

- Healthcare Organizations: Providers managing health records and processing financial transactions need SOC 1 for financial reporting assurance and SOC 2 to comply with stringent data protection laws like HIPAA.

- Technology and SaaS Providers: Firms that handle sensitive customer data and provide services impacting financial statements must ensure both SOC 1 compliance for financial accuracy and SOC 2 for operational security and data integrity.

- Data Centers and IT Service Providers: Businesses offering infrastructure and managed services may be required to demonstrate robust controls over financial reporting with SOC 1 and operational controls with SOC 2.

The Role of Compliance Automation Solutions

Achieving and maintaining compliance with both SOC 1 and SOC 2 can be a complex and resource-intensive process. This is where compliance automation solutions, such as Drata, come into play. These platforms streamline and simplify the compliance journey, offering several key benefits:

1. Continuous Monitoring and Real-Time Updates

Compliance automation tools continuously monitor your organization’s controls and systems, providing real-time updates and alerts. This ensures that you are always aware of your compliance status and can address any issues promptly.

2. Centralized Compliance Management

These solutions offer a centralized dashboard where you can manage all aspects of your compliance efforts. This includes tracking the progress of your SOC 1 and SOC 2 audits, managing documentation, and collaborating with stakeholders.

3. Automated Evidence Collection

Manually gathering evidence for audits can be time-consuming and error-prone. Compliance automation platforms automatically collect and organize evidence required for SOC 1 and SOC 2 audits. This reduces the burden on your team and minimizes the risk of missing critical information.

4. Simplified Audit Preparation

Compliance automation solutions guide you through the audit preparation process, providing templates, checklists, and best practices. This helps ensure that you are well-prepared for both SOC 1 and SOC 2 audits, increasing the likelihood of a successful outcome.

5. Enhanced Security and Data Protection

These platforms often include advanced security features to protect your compliance data and ensure it remains confidential and secure. This is particularly important for organizations handling sensitive customer information.

Using compliance automation solutions like Drata, businesses can more effectively manage the complexities of maintaining SOC 1 and SOC 2 compliance. These tools simplify the compliance process and provide ongoing support to ensure that your organization remains compliant with evolving standards and regulations. This proactive approach to compliance helps build trust with clients and stakeholders, demonstrating your commitment to maintaining the highest security and operational excellence standards.

Final Thoughts

Understanding the differences between SOC 1 and SOC 2 is crucial for organizations that prioritize compliance and data protection. SOC 1 addresses financial reporting controls, while SOC 2 covers broader operational areas—security, availability, processing integrity, confidentiality, and privacy. Whichever report you choose, proper audit preparation requires solid planning, thorough documentation, and a commitment to maintaining strong controls.

Achieving SOC compliance meets regulatory and client expectations and builds trust in your data management practices. If you need support managing the complexities of SOC compliance, Bright Defense offers expert guidance and cybersecurity solutions to help you meet required standards and achieve successful audit outcomes. Contact us today to improve your security posture and simplify your compliance journey.

Bright Defense Delivers SOC 1 and SOC 2 Compliance!

If you need SOC 1 or SOC 2 compliance, Bright Defense can help. Our monthly engagement model will deliver a robust cybersecurity program to meet compliance frameworks including SOC 1, SOC 2, PCI, ISO 27001, HIPAA, CMMC, and more. Our continuous compliance plans include Drata’s compliance automation platform to increase efficiency in the process.

Additional services include risk assessments, business continuity planning, security awareness training, endpoint protection, penetration testing, and vCISO services. Contact Bright Defense today to get started on your compliance journey!

FAQ: Understanding SOC 1 vs SOC 2

What is the primary difference between SOC 1 vs SOC 2?

SOC 1 focuses on financial controls and is designed to ensure the accuracy and integrity of financial reporting. It is primarily used by service organizations that impact their clients’ financial statements. On the other hand, SOC 2 addresses a broader range of operational controls, including security, availability, processing integrity, confidentiality, and privacy. SOC 2 is applicable to organizations that handle sensitive information and need to demonstrate robust data protection practices.

Why are SOC reports important for businesses?

SOC reports provide assurance to clients and stakeholders that an organization has effective controls in place. These reports, conducted by certified public accountants, evaluate an organization’s control environment and help build trust by demonstrating compliance with industry standards. SOC reports are essential for organizations that want to prove their commitment to security, data protection, and operational excellence.

Who conducts SOC audits?

SOC audits are conducted by certified public accountants (CPAs) from reputable accounting firms. These auditors assess the design and operating effectiveness of an organization’s controls against the relevant SOC criteria. The audit process includes evaluating documentation, testing controls, and providing an opinion on their effectiveness.

What are the key control objectives in a SOC 1 report?

A SOC 1 report focuses on key control objectives related to financial reporting. These objectives include ensuring the accuracy, completeness, and reliability of financial data processed by the service organization. The report evaluates controls over processes such as payroll processing, transaction processing, and financial reporting services.

Can an organization need both a SOC 1 and SOC 2 report?

Yes, some organizations may require both a SOC 1 and SOC 2 report. This is often the case for businesses that provide services impacting financial reporting (requiring SOC 1) and handle sensitive information that needs to be protected (requiring SOC 2). Dual compliance helps organizations meet diverse client and regulatory requirements.

How do SOC 2 reports address sensitive information?

SOC 2 reports focus on the Trust Service Criteria, which include security, availability, processing integrity, confidentiality, and privacy. These criteria ensure that an organization’s systems are designed to protect sensitive information, maintain data integrity, and ensure availability. SOC 2 reports provide assurance that an organization has implemented effective controls to safeguard client data.

What is the financial focus of a SOC 1 report?

The financial focus of a SOC 1 report is on internal controls over financial reporting (ICFR). This includes evaluating processes and controls that ensure the accuracy and reliability of financial data. SOC 1 reports are crucial for organizations that impact their clients’ financial statements, such as payroll processors and financial service providers.

Why do organizations rely on SOC audits?

Organizations rely on SOC audits to demonstrate their commitment to effective control environments and regulatory compliance. SOC audits provide independent verification of an organization’s controls, helping to build trust with clients, stakeholders, and regulators. They also identify areas for improvement, enhancing the overall security and operational effectiveness of the organization.

What are the control objectives of a SOC 2 report?

The control objectives of a SOC 2 report are based on the Trust Service Criteria. These include:

- Security: Protecting system resources against unauthorized access.

- Availability: Ensuring the system is available for operation and use.

- Processing Integrity: Ensuring system processing is complete, accurate, and authorized.

- Confidentiality: Protecting information designated as confidential.

- Privacy: Protecting personal information according to the organization’s privacy notice.

How do accounting firms assist with SOC 1 vs SOC 2 compliance?

Accounting firms, staffed with certified public accountants, play a crucial role in assisting organizations with SOC 1 vs SOC 2 compliance. They conduct the audits, evaluate control environments, and provide reports that verify an organization’s adherence to the relevant standards. Their expertise helps organizations navigate the complexities of SOC compliance and ensures that controls are effectively designed and operated.

How do SOC audits help in achieving compliance?

SOC audits help organizations achieve compliance by providing a structured assessment of their control environments. The audit process involves testing controls, identifying gaps, and making recommendations for improvement. By undergoing regular SOC audits, organizations can ensure that their controls remain effective and compliant with industry standards, thereby maintaining trust and credibility with clients and stakeholders.

Get In Touch